In light of developments from the FDA, analysts remain bullish on both Relypsa Inc (NASDAQ:RLYP) and Sangamo Biosciences, Inc. (NASDAQ:SGMO).

Relypsa Inc

Mara Goldstein of Cantor reiterated a Buy rating on Relypsa with a $42 price target in light of FDA documents regarding Veltassa.

Veltassa is Relypsa’s commercialized drug for hyperkalemia, or high potassium levels in blood. Although the drug gained FDA approval, it comes with a black box warning; a severe warning on the box of the drug that signifies serious risk. Goldstein comments, “Our view continues to be that the black box warning regarding dosing separation will ultimately prove not to be a major impediment to commercial success, even if it remains and with potential competition on the horizon.” The analyst adds, “Reading through the FDA documents, we think Relypsa shares were hit with profit taking based on statements that suggest that even a lack of clinical significance of drug-drug interaction (DDI) studies may not be relevant enough to change Veltassa’s label.”

The analyst also mentions ZS9, which is developed by ZS Pharma and is a pipeline competitor to Veltassa. Goldstein notes that interim long-term results of the drug were recently presented and comments, “Our view is that data generated thus far suggests that ZS9’s profile may leave a greater margin for Veltassa than the market is internalizing following the drug’s approval with the black box warning.” Since the hyperkalemia market encompasses over 3 million patients, Goldstein believes there is room for both drugs to thrive.

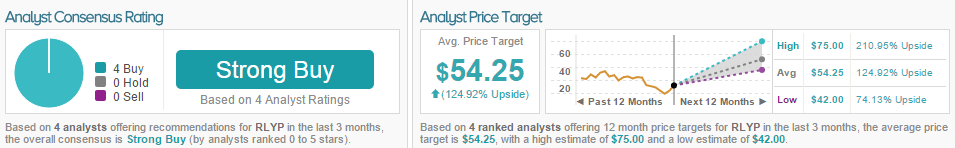

Goldstein’s bullish sentiment is echoed by all four analysts polled by TipRanks in the last three months, all of whom are bullish on RLYP. The average 12-month price target between the 4 analysts is $54.25, marking a 125% potential increase from where the stock last closed.

Sangamo Biosciences, Inc.

Cory Kasimov of JP Morgan came out with a few comments on Sangamo Biosciences after the company’s Investigational New Drug application for SB-FIX-1501 was approved by the FDA. The analyst rated the stock an Overweight with a $16 price target.

Kasimov noted, “We are encouraged by the announcement that the FDA has cleared SGMO’s IND for SB-FIX, a gene-editing (i.e. one-time) based therapy for the treatment of hemophilia B. This is in line with expected timing, and not entirely surprising, in our view, following the company’s unanimously positive RAC (Recombinant DNA Advisory Committee). This is notable, as this will be SGMO’s 2nd Zinc Finger-based therapy to enter the clinic, and the first from the company’s In Vivo Protein Replacement Platform (IVPRP).”

Looking forward, Sangamo plans to file an Investigational New Drug application to enable studies in hemophilia A in the first quarter of 2016. Additionally, the company will submit INDs for its Hurler and Gaucher programs by the end of the year. Kasimov comments, “Overall, We continue to see SGMO as an early but attractive way to gain exposure to the emerging gene therapy/editing field given its diversified pipeline and differentiated technology platform.”

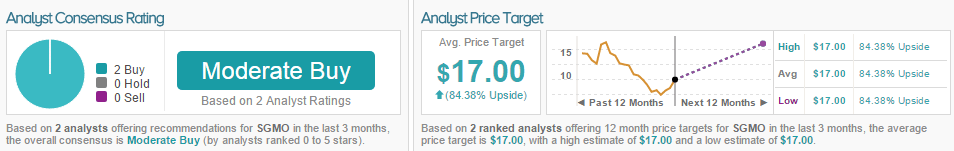

According to TipRanks, both other analysts who have rated Sangamo in the last three months are bullish on the stock. The average 12-month price target between these two analysts is $17, marking an 84% potential upside from where shares last closed.