Executive Summary

- Founded in 1978 – Micron Technology, Inc. (NASDAQ:MU) is one of the leaders in the field of semiconductor solutions

- Revenues are derived from 2 main areas – DRAM 68% vs NAND 27%

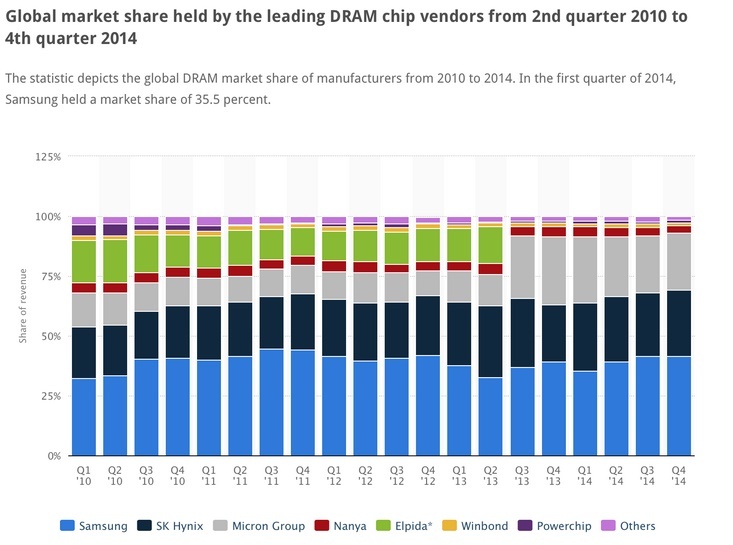

- Micron is the third out of 3 major suppliers in DRAM market share – 24% of global market

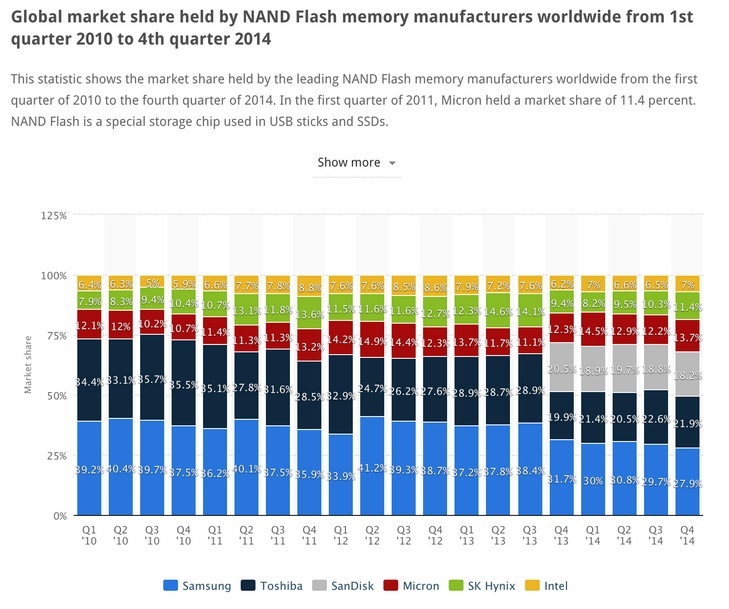

- Micron is the fourth out of 4 major suppliers in NAND market share – 13.7% of global market

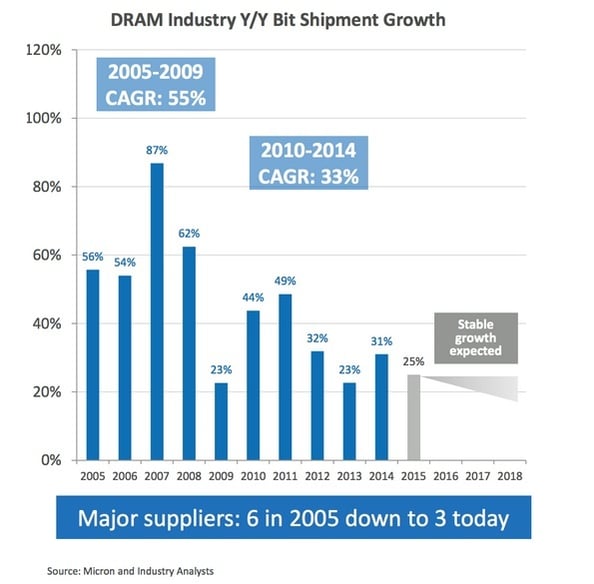

- DRAM growth has been 33% CAGR (2010 – 2014) – forecast to be 25% CAGR to 2018

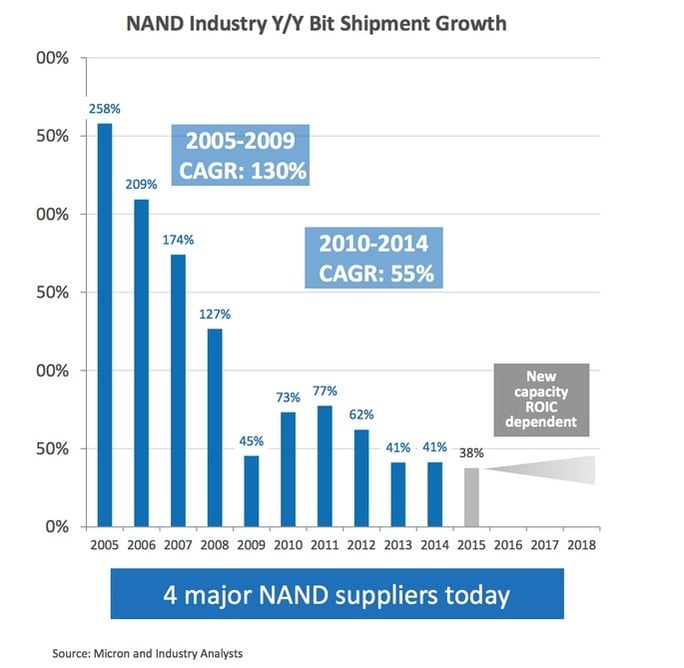

- NAND growth has been 55% CAGR (2010 – 2014) – forecast to be 38% CAGR to 2018

- Management team have capex target of 19% of revenues (currently spending 9%)

- Micron do not pay a dividend however they do have a $1 billion common stock repurchase authorization with ~$200M completed as of 11 Feb 2015

Semiconductor Industry

The DRAM and NAND market is an extremely competitive market where the watch words are constant innovation and productivity enhancements. The market has consolidated to 3 – 4 major players going forward. The growth prospects are looking good forward with ever more smart devices driving the need for more components across the consumer, networking and server spectrum.

DRAM Market Dynamics

NAND Market Dynamics

Growth Going Forward

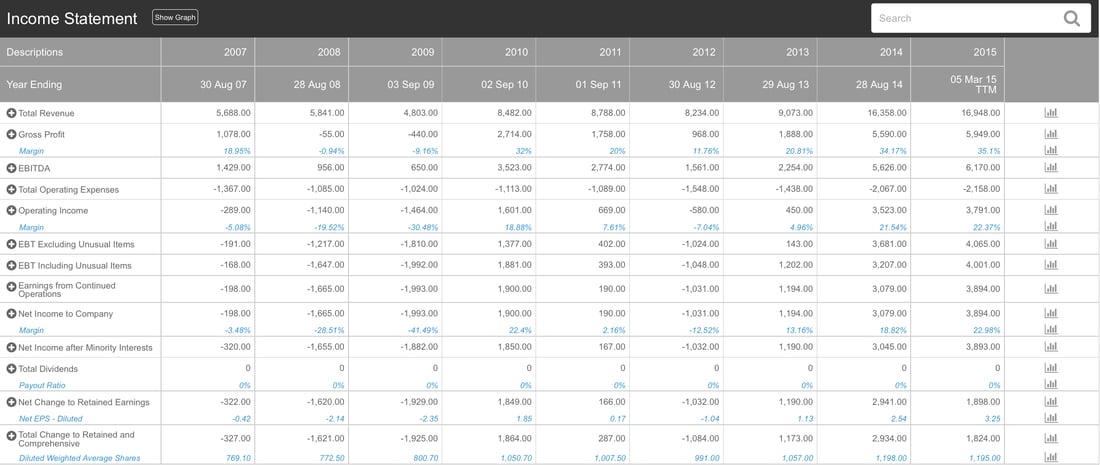

Micron was starting to show renewed operating profit before the acquisition of Elpida in 2013. The Elpida acquisition has clearly been a game changer for Micron’s business both in terms of scale, capability and new clients (notably Apple). It also helped deliver a windfall of $ 1.4 billion. The management team seem to have capitalised on all of this to deliver a 20% operating income margin.

The challenge for the management team going forward will be to maintain profitability whilst being the smallest player in the industry (even after the Elpida acquisition). Chip manufacture is a highly competitive market where prices are constantly under pressure and the innovation curve is very steep. Micron currently spend 9% of revenues on Research and Development. To augment this they have a number of joint ventures which enable them to leverage other companies Intellectual Property and scale to compete with the larger players.

On the positive side the requirement for DRAM and NAND is growing rapidly with the addition of new smart devices into everything from the home to the car. There are no new major fabrication plants coming online until Samsung’s new plant in 2017 which should mean stable prices in the short to medium. Whilst Samsung’s new plant will result in them doubling capacity, the market is forecast to double by 2017. We therefore do not anticipate this having a major impact on Micron’s business. Micron have also acquired Apple as a client which bodes well given the friction between Apple and Samsung.

We are currently forecasting 9.52% growth going forward.

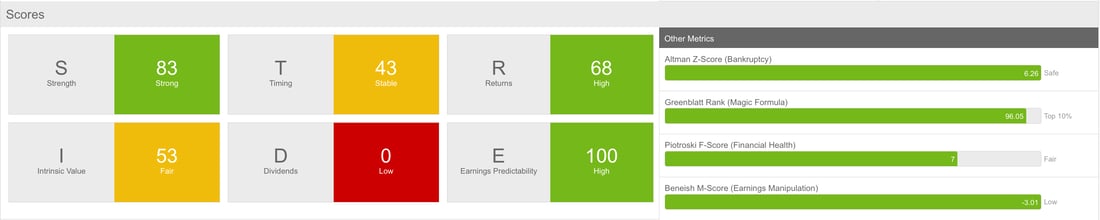

STRIDE Scores

STRIDE scores for the business are looking good. For more info on how the scores work, take a look at the scores and ratings video.

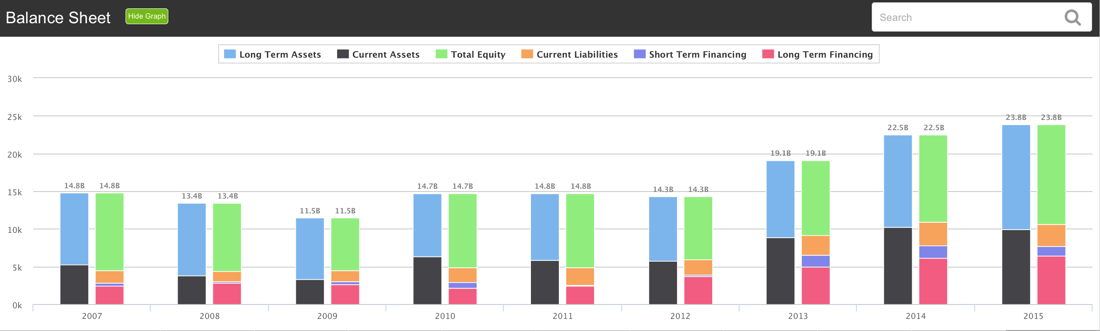

The strength score is 83 and we can see from the balance sheet that they maintain a very healthy cash position and good liquidity. Their long term debt pile sits at $5.824 billion which is equal to 1.5 times their current net income. The ageing of the debt is very favourable with 58% due + 5 years.

The timing score is 43 showing that the price is stable and not trending.

The returns score is 68 and we can see that this is reflected in the numbers with their ROE at 35.86% while ROCE is 19.25%.

The intrinsic value score of 53 is fair and means that there are hard assets to support the share price.

The dividend score is 0 as Micron do not pay any dividends.

Earnings predictability is 100 – this shows the constant upward trend in revenues, profit and profitability since 2010 (with the exception 2012)

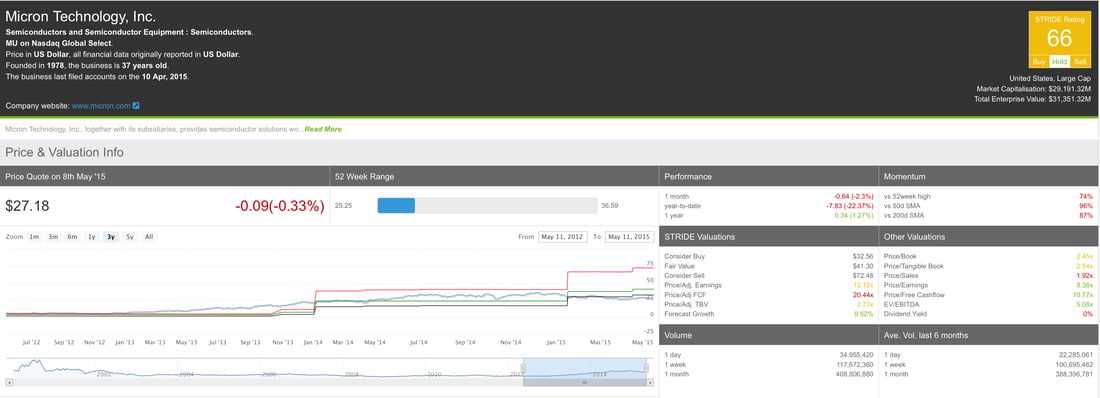

STRIDE Valuation

Our fair value sits at $41.30. We are seeking a discount of ~$9 / 22%, which we feel provides adequate safety for a good entry point. This makes the current share price of $ 27.18 provides a good entry point at the moment. We would wait to see a more positive trend in the share price (Timing Score over 60) before entering.

STRIDE Financials

The income statement shows continued growth from 2010 (with the exception of 2012).

The balance sheet shows a constant increase as the business adds more capacity.

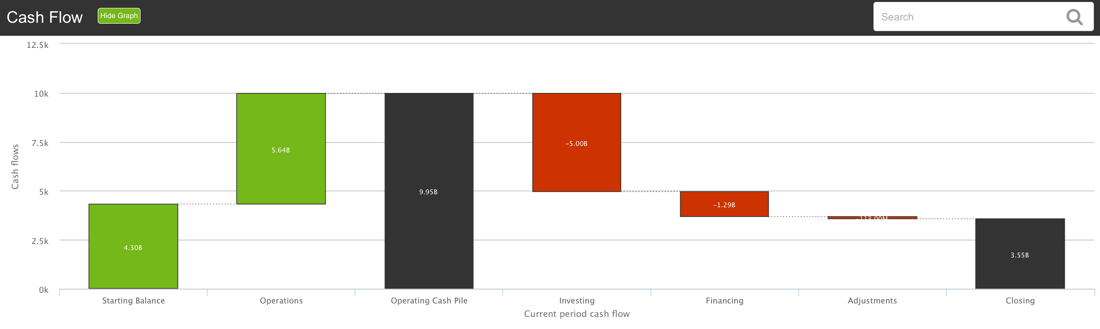

The cash flow shows that the company maintains healthy percentage of cash in the business. Micron are choosing to return cash to shareholders through share repurchases.

Conclusion

Micron is in a highly competitive industry. We feel that the management team have been very shrewd with the Elpida acquisition and are demonstrating continuous profitability and growth going forward. Saying that we have a strong suspicion that there may be further consolidation in the market as technology continues to converge. Technology companies are sitting on record amounts of cash currently and we are already seeing a number of potential acquisitions being discussed. Micron being the smallest out of all the players would be a prime target and would be cheap at a PE Ratio of 8.36.

Micron is currently on our watchlist and we are looking for more positive Timing score before entering.