Bank of America (NYSE:BAC) faces another investigation by the SEC, alleging that the multi-national financial institution failed to protect sensitive client account information. The SEC claims that BofA executed sophisticated trades using millions of dollars that the bank would otherwise use for funding costs. In order to execute the trades, the SEC alleges Bank of America violated their brokerage account customer’s consumer protection rights.

Several analysts who follow BofA continue to place a buy rating on the stock. However, the analysts fail to mention the turmoil brewing within the company’s hierarchy. The latest SEC investigation adds fuel to the fire of speculation that a major shake-up in leadership is closer than most analysts with a buy rating, or a financial stake, want to believe.

More Dissatisfaction With Management

Since ascending to the role of CEO in 2010, Bank of America’s Brian Moynihan has been putting out fires on a number of fronts while at the same time, attempting to keep shareholders happy. It has been an arduous battle, and the recent quarterly reportblackened the future even further. Even when BofA reports profits, he still receives scathing criticism, albeit not without justification.

Moynihan has a “top down” dictatorial management style that has been at odds with Merrill’s entrepreneurial one from the start. Moynihan has incorporated cross selling of BofA products to Merrill clients – but without reciprocation of business from BofA to Merrill brokers. Moynihan’s strategies focus on capturing as many millionaire accounts as possible.

Merrill has long built its loyal client base by helping people with small accounts grow their net worth through participation in Merrill IPOs and other products. BofA decreed that any accounts under $250,000 were not to be opened by Merrill brokers and were to be referred to an 800 toll free number.

In a NY Post article, a former Merrill broker with over 30 years of history there took his team to Raymond James due to the “bank first” philosophy of BofA executives vs. the “client first” reputation that Merrill has cultivated throughout much of the latter half of the 20th century.

Additional Issues Weigh on Latest Earnings Report

Bank of America has a significant portion of its business still tied to interest rates. Commercial lending and many of its other banking products are all interest rate dependent. With the vestiges of the huge but troubled Countrywide Mortgage portfolio continuing to drain a significant amount of funds for servicing, there are remaining trailing legal liabilities, but they are finally winding down.

BofA posted profits, but much of the numbers were due to reduced legal costs of up to $6 billion vs same quarter last year. Moynihan also deployed drastic cost cutting measures, which reduced expenses by almost 30%. However, a good portion of this cost cutting was in personnel, which equated to almost 19,000 employees, or 7% of B of A’s workforce receiving pink slips.

Competitors Gain Traction

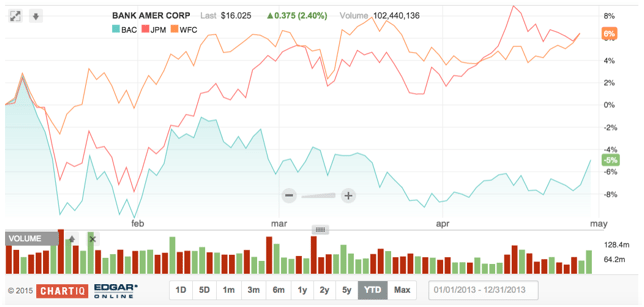

Bank of America’s top competitors, Wells Fargo (NYSE:WFC) and JP Morgan Chase (NYSE:JPM), continue to outperform while BACs stock price remains stuck in a tight vacuum. BofA stock charts show very little price movement over the past couple of months, trading within the $15 to $17 range during that time. Although BofA reported 3.6 billion in net income, the year-to-date stock price is down nearly 12 percent.

Executives Gain, Shareholders Lose

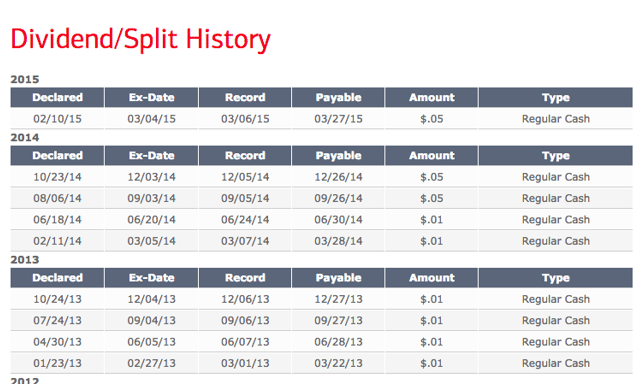

It appears that executives at Bank of America have lost sight of the fact that shareholders own the company. While top-level executives take home millions of dollars in salary and bonuses, the shareholders earn next to nothing from the stock, especially with a dividend payment of 1 percent. BofA currently pays a .20 cent per share dividend on preferred stocks, as of April 2015. Compare that with Wells Fargo and JP Morgan, who pay 2.6 percent per share of preferred stock owned.

Conclusion: Consider BAC’s Competitors Instead

The announcement of an SEC investigation into BofA’s attempt to free up cash by compromising its customers personal information may cause analysts to change their tune. With a lack of real leadership needed to run a so-called “too big to fail” bank, the buy and hold recommendation by analysts may lose its luster with investors who are still skeptical of banks and their business practices.

The great recession of 2008 is still fresh in many people’s minds, and it may take several more years for banks to win back some degree of trust among their customers. A federal investigation certainly does not help BofA and its effort to win back consumer confidence.

We remain very cautious on prospects for BAC shareholders in 2015.